eth btc bottom Trends and Insights for Traders

eth btc bottom signifies a crucial juncture in the cryptocurrency landscape, where traders seek to pinpoint the lowest price points before a potential rebound. Understanding these bottoms is essential for making informed trading decisions, as they reflect both market dynamics and trader psychology.

In this discussion, we will delve into the historical performance of Ethereum and Bitcoin, analyze technical indicators that signal these market bottoms, and explore how market sentiment plays a pivotal role in their formation. By examining past patterns and current trends, traders can better navigate the complexities of the crypto market.

Understanding the Concept of Bottoms in Crypto Markets

Identifying market bottoms is crucial for traders and investors in the cryptocurrency landscape, where volatility is the norm. Understanding when a market has reached its lowest point can significantly influence trading strategies and investment decisions. Market bottoms often signify a turnaround, making them an essential concept for anyone involved in crypto trading.Psychological factors play a significant role in how traders perceive market bottoms.

Fear and greed often dictate the market sentiment, leading to irrational decision-making. For instance, during bearish trends, traders may panic and sell off their holdings, further driving prices down. Conversely, periods of accumulation can signal that savvy investors see the potential for recovery. Historical examples of market bottoms for Ethereum (ETH) and Bitcoin (BTC) illustrate these points well. For instance, BTC hit a notable bottom in December 2018 after a prolonged decline, eventually leading to a bullish rally that saw it reach new heights.

Historical Performance of ETH and BTC

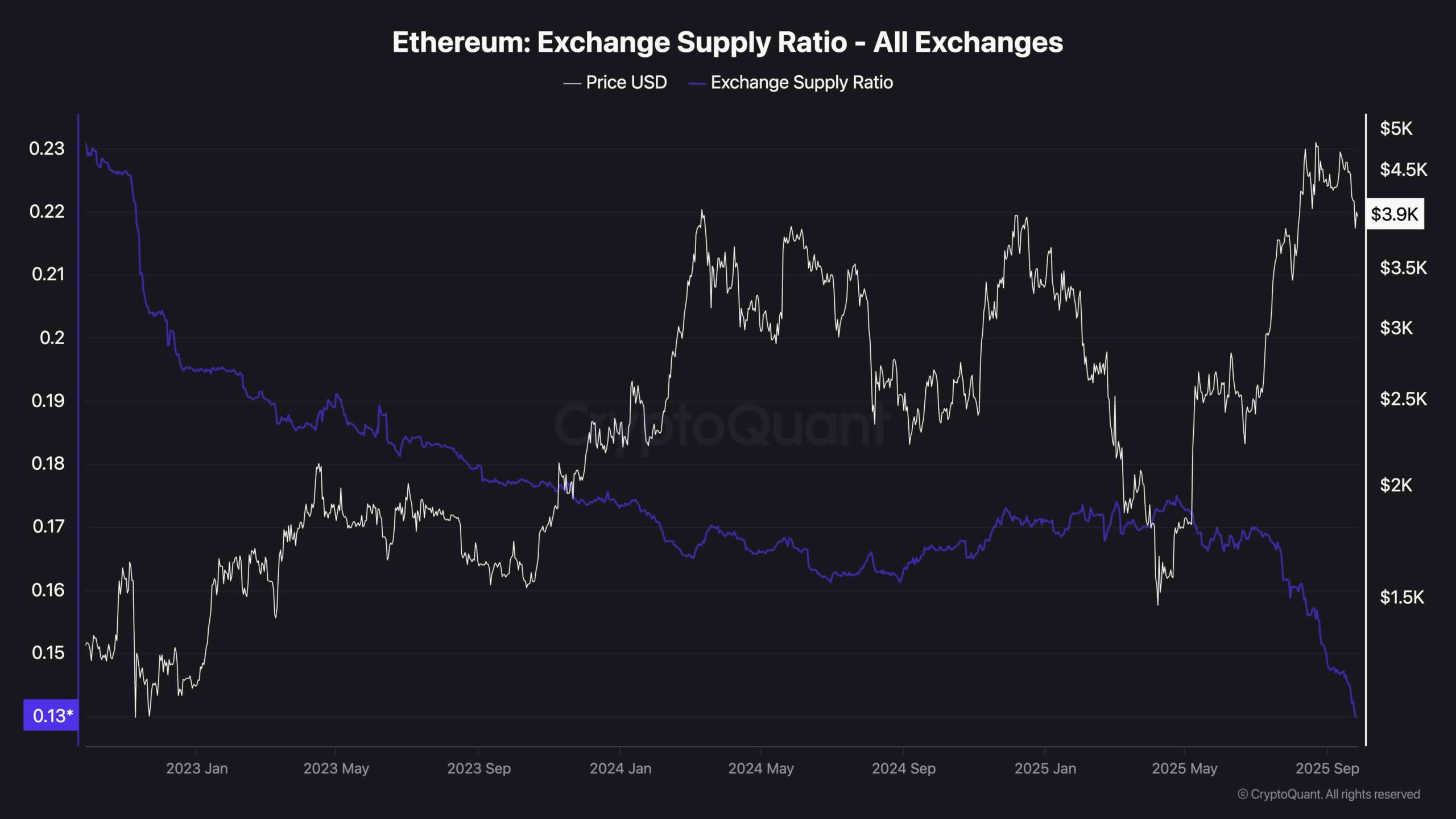

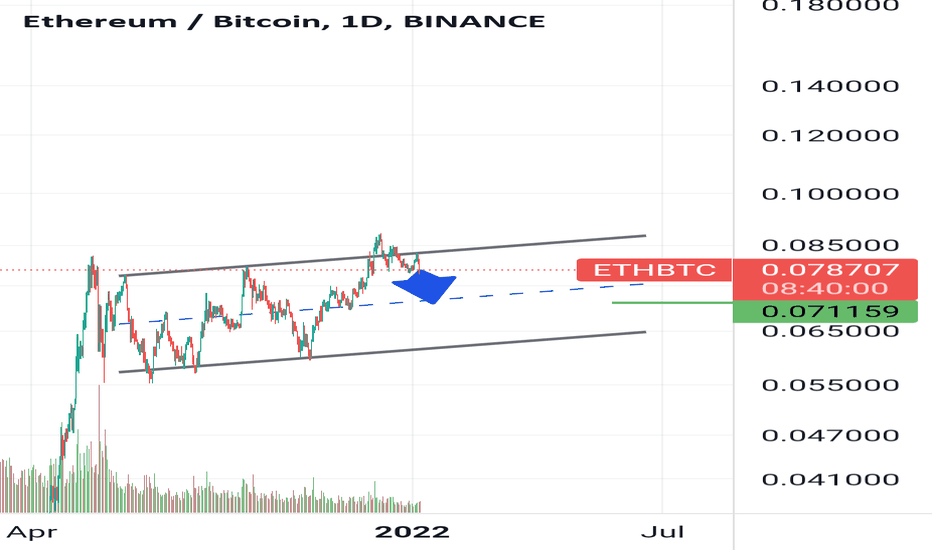

Analyzing the historical performance of ETH and BTC reveals patterns that can help traders identify potential bottoms. Both cryptocurrencies have experienced sharp price corrections followed by significant recoveries. For example, after a peak in January 2018, both coins witnessed substantial drops, with BTC falling to around $3,000 by the end of the year and ETH dropping to approximately $80.Key events have historically triggered major price drops for ETH and BTC.

These include regulatory news, security breaches, or even macroeconomic shifts that affect market confidence. Following these drops, recovery patterns tend to vary; however, both cryptocurrencies have shown a tendency to bounce back in the following months or years, often exceeding their previous all-time highs.

Technical Indicators for Identifying Bottoms

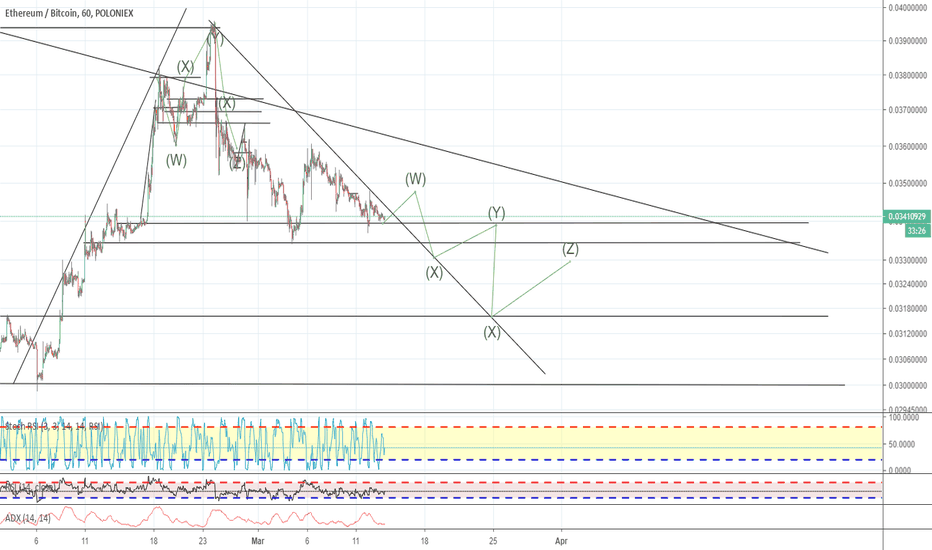

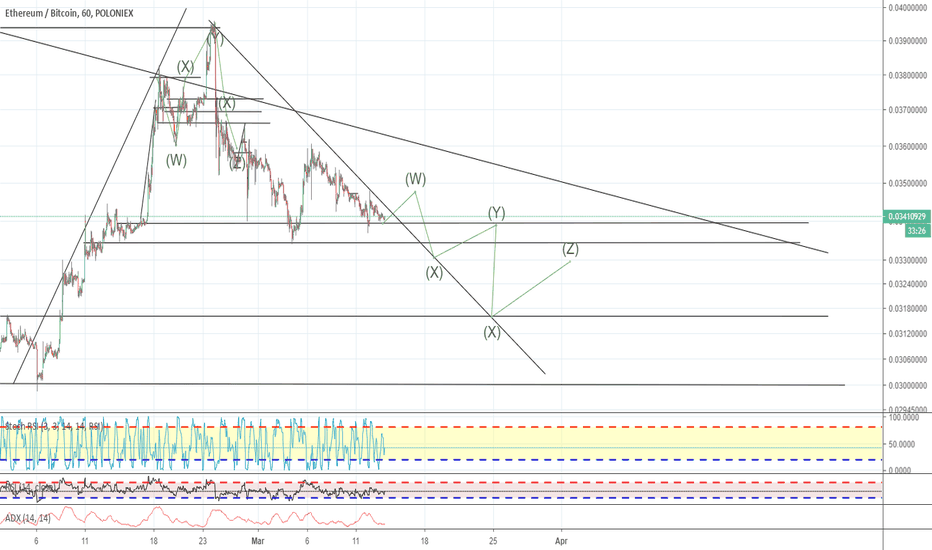

Technical indicators are invaluable tools for traders aiming to identify potential market bottoms. Moving averages, particularly the 200-day and 50-day moving averages, can signal trend reversals when they converge or cross in specific ways. The Relative Strength Index (RSI) is another powerful indicator that helps assess whether an asset is overbought or oversold, typically indicating a potential bottom when it dips below 30.Common chart patterns associated with market bottoms include double bottoms and cup-and-handle formations.

These patterns often indicate a consolidation phase before a price increase, providing traders with crucial cues for entry points.

Market Sentiment and Its Role in Bottom Formation

Market sentiment significantly influences the formation of market bottoms for ETH and BTC. A positive shift in sentiment can signal the end of a bearish trend, while widespread fear can exacerbate downturns. Gauging sentiment through social media platforms and news outlets provides traders with insights into market psychology.To effectively gauge market sentiment, one can utilize various sentiment indicators. For instance, the Fear and Greed Index quantifies market sentiment based on various factors, including volatility and social media activity.

A table comparing sentiment indicators could include metrics like the number of positive or negative mentions on social media platforms, which often correlate with price movements.

| Sentiment Indicator | Description | Impact on Market Movements |

|---|---|---|

| Fear and Greed Index | Measures market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed) | High greed can lead to price increases, while extreme fear can trigger sell-offs |

| Social Media Mentions | Tracks the volume of positive vs. negative discussions about ETH and BTC | A surge in positive mentions often precedes a price rally |

| Google Trends | Monitors search interest in cryptocurrency-related terms | An increase in searches can indicate rising interest and potential price increases |

Future Predictions for ETH and BTC Bottoms

Predicting future market bottoms for ETH and BTC involves analyzing historical data and identifying recurring patterns. Data-driven methodologies, including statistical modeling and chart analysis, can provide insights into potential price movements. Macroeconomic factors, such as inflation rates and global economic stability, also play a significant role in shaping future price trends.Insights into potential scenarios that could lead to new market bottoms include regulatory changes, shifts in investor sentiment, or technological advancements impacting the utility of both cryptocurrencies.

For example, an increase in institutional investment could create upward pressure, while adverse regulatory news might trigger another downturn.

Risk Management Strategies When Trading Near Bottoms

Implementing risk management techniques is crucial when trading near market bottoms. Setting stop-loss orders can help limit potential losses, while take-profit orders ensure that traders secure gains when prices rise. Effective risk management practices help traders navigate the volatility associated with crypto markets.Best practices for managing trades near perceived bottoms include:

- Regularly reassessing market conditions and adjusting stop-loss levels accordingly.

- Diversifying investments to spread risk across multiple assets.

- Keeping a close watch on relevant news and market sentiment to anticipate possible shifts.

- Defining clear entry and exit strategies to avoid emotional trading decisions.

Case Studies of Recent Market Bottoms

Recent market bottoms in ETH and BTC provide invaluable case studies for traders. For instance, the bottom reached in March 2020 during the COVID-19 pandemic triggered a significant recovery, with both cryptocurrencies rebounding sharply as investors sought refuge in digital assets. Analyzing these formations helps traders understand the factors that contribute to market recoveries.Lessons learned from these case studies emphasize the importance of timing and sentiment analysis.

Reactions from the crypto community often reflect broader market sentiments, influencing future price movements. Assessing these reactions can provide insights into potential buy-in opportunities and risk factors moving forward.

Last Point

In summary, identifying the eth btc bottom is not just about recognizing price levels; it encompasses understanding market psychology, utilizing technical analysis, and being aware of external factors that can influence price movements. By applying these insights and strategies, traders can enhance their decision-making processes and potentially capitalize on future market opportunities.

FAQ

What is a market bottom in crypto?

A market bottom in crypto refers to the lowest price point that a cryptocurrency reaches before starting to rise again.

How do I identify a potential bottom for ETH and BTC?

You can identify potential bottoms by using technical indicators like moving averages and the Relative Strength Index (RSI).

Do market bottoms guarantee price recovery?

No, while a bottom can indicate a potential recovery, it does not guarantee that prices will rise, as other factors may influence the market.

How can I manage risk when trading near market bottoms?

Implementing stop-loss orders and setting clear take-profit levels are effective strategies for managing risk when trading near bottoms.

What role does market sentiment play in identifying bottoms?

Market sentiment can greatly influence price movements; positive sentiment can lead to recoveries, while negative sentiment can prolong downtrends.