Difference Between Bitcoin And Ethereum Technology Explained

Exploring the difference between bitcoin and ethereum technology reveals a vibrant landscape of innovation and purpose in the cryptocurrency world. Each platform serves distinct objectives and has unique foundational technologies, shaping how they are utilized across various industries.

Bitcoin, designed as a digital currency, emphasizes decentralization and security, while Ethereum expands on this by introducing smart contracts and a robust ecosystem for decentralized applications. Understanding these differences not only highlights their individual strengths but also sheds light on their roles in the future of finance and technology.

Introduction to Bitcoin and Ethereum

Bitcoin and Ethereum are two of the most prominent cryptocurrencies, each serving distinct purposes within the blockchain ecosystem. Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first decentralized digital currency, created primarily as a medium of exchange and a store of value. Ethereum, launched in 2015 by Vitalik Buterin and others, extends the concept of blockchain beyond simple monetary transactions to enable decentralized applications and smart contracts.The vision behind Bitcoin is to create a peer-to-peer electronic cash system, free from central banks and financial institutions.

Ethereum, on the other hand, aims to be a global platform for decentralized applications, allowing developers to build applications that run without interference from a third party. Historically, Bitcoin has paved the way for the rise of cryptocurrencies, while Ethereum has introduced complex programmability to the blockchain, significantly broadening its use cases.

Technical Foundations

The underlying technologies of Bitcoin and Ethereum are fundamentally different yet complementary. Bitcoin is built on a proof-of-work (PoW) consensus mechanism that secures the network through mining, where miners solve complex mathematical problems to validate transactions. Ethereum originally used PoW as well, but it has transitioned to a proof-of-stake (PoS) system with the Ethereum 2.0 upgrade, which aims to enhance scalability and reduce energy consumption.In terms of programming languages, Bitcoin’s scripting language is relatively simple and limited, designed primarily for transaction scripting.

Ethereum, on the other hand, introduces a more robust programming language called Solidity, which allows developers to create sophisticated smart contracts. This difference in foundational technology reflects the unique purposes of each cryptocurrency.

Smart Contracts and Functionality

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Ethereum was designed from the ground up to support smart contracts, enabling developers to create complex decentralized applications (dApps) that can operate autonomously. In contrast, Bitcoin provides limited scripting capabilities, which restricts its functionality primarily to transactional purposes.Ethereum’s smart contracts have paved the way for a multitude of real-world applications, such as decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and supply chain management solutions.

For instance, platforms like Uniswap and Compound utilize Ethereum's smart contracts to facilitate decentralized trading and lending, showcasing the versatility and innovation possible within Ethereum’s ecosystem.

Network Scalability

Scalability remains a critical challenge for both Bitcoin and Ethereum. Bitcoin's transaction speed averages around 7 transactions per second (TPS), which can lead to delays and higher fees during peak times. To address these issues, Bitcoin has implemented layer 2 solutions like the Lightning Network, which allows for faster transactions by creating off-chain payment channels.Ethereum’s current transaction speed is approximately 30 TPS, but its shift to PoS and the implementation of sharding in future upgrades aim to significantly increase capacity.

Layer 2 solutions like Optimistic Rollups and zk-Rollups are also being developed to improve throughput while maintaining security. These advancements in scalability are essential for both networks to handle increasing user demand effectively.

Use Cases and Applications

Bitcoin and Ethereum serve different primary use cases. Bitcoin is primarily viewed as digital gold, a secure and decentralized asset for value storage and transfer. It is widely adopted as a hedge against inflation and economic instability. Meanwhile, Ethereum's flexibility allows it to address a variety of applications, from finance to gaming, making it a platform for innovation.Various industries leverage the capabilities of both technologies.

For instance, Bitcoin is often utilized by financial institutions for cross-border payments, while Ethereum is sought after by developers for building dApps. Notable examples in the Ethereum ecosystem include decentralized exchanges, gaming platforms like Axie Infinity, and governance tools for decentralized autonomous organizations (DAOs), illustrating the profound impact of Ethereum's smart contracts.

Market Dynamics and Value Proposition

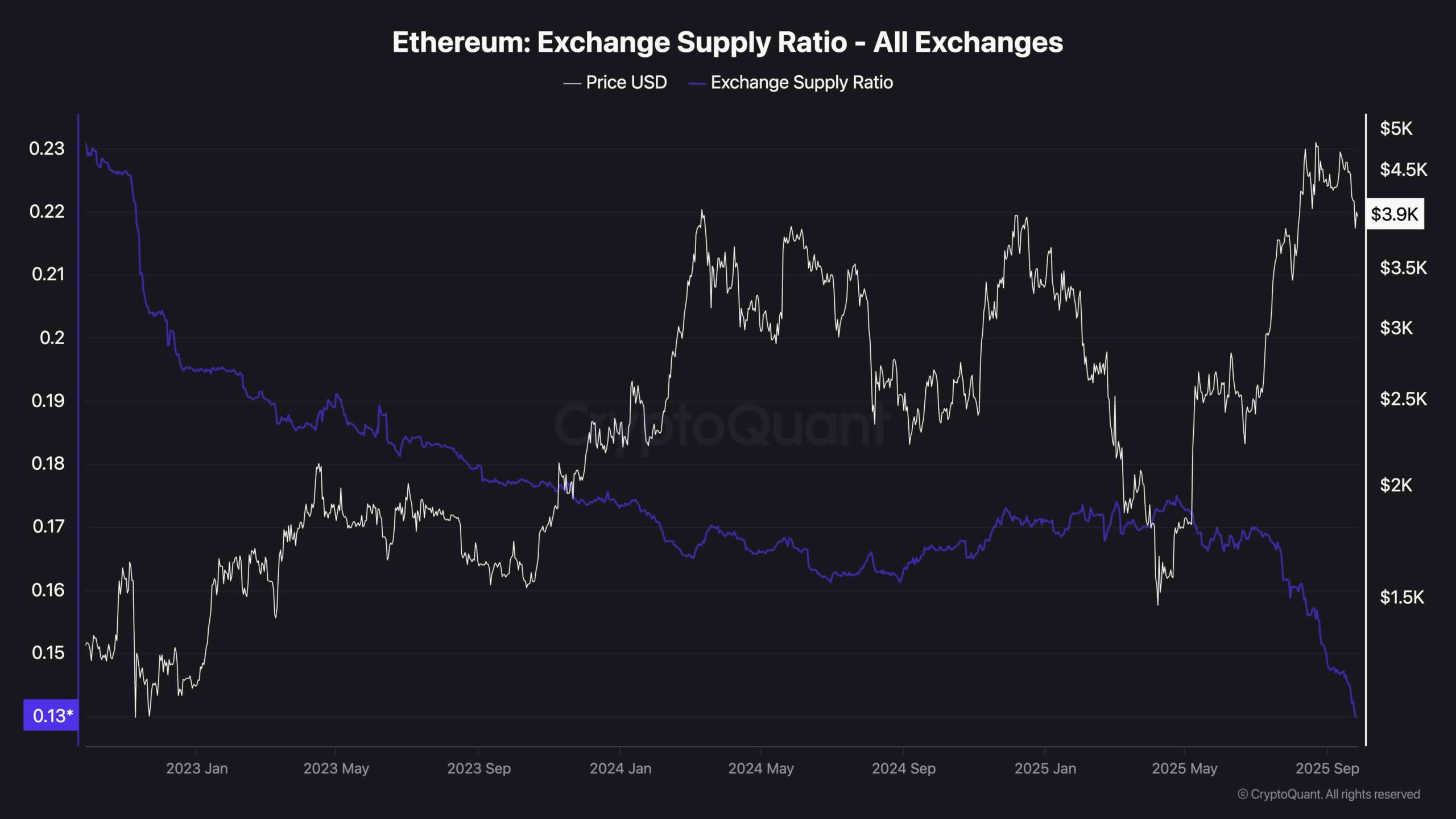

Bitcoin and Ethereum hold significant positions in the cryptocurrency market, often referred to as the "digital gold" and "global computer," respectively. Factors influencing their value include market demand, regulatory developments, and technological advancements. Bitcoin's scarcity (capped at 21 million coins) adds to its appeal as a deflationary asset, whereas Ethereum's value is increasingly tied to the utility of its smart contracts and the growing DeFi sector.From an investment perspective, Bitcoin is considered a safer asset due to its established track record, while Ethereum presents growth opportunities through its expansive potential applications.

However, Ethereum also carries higher risk due to its ongoing developments and competition from other smart contract platforms.

Community and Governance

Governance models differ between Bitcoin and Ethereum. Bitcoin operates on a more conservative governance model, where significant changes require broad consensus within the community. In contrast, Ethereum’s governance is more dynamic, with the Ethereum Foundation and community developers actively proposing and implementing changes.Community engagement plays a vital role in the development of both technologies. Bitcoin's community is renowned for its commitment to security and stability, while Ethereum's vibrant developer community is focused on innovation and experimentation.

This engagement shapes the future of both cryptocurrencies and their respective ecosystems.

Security and Vulnerabilities

Both Bitcoin and Ethereum have robust security features, including cryptographic hashing and decentralization, which help mitigate the risk of attacks. However, vulnerabilities have been exposed over time, with Bitcoin experiencing issues related to exchange hacks and Ethereum facing challenges with smart contract exploits.Best practices for securing assets include using hardware wallets to store cryptocurrencies, enabling two-factor authentication on exchanges, and regularly updating wallet software.

These measures are essential for users to protect their investments on both platforms.

End of Discussion

In conclusion, the difference between bitcoin and ethereum technology underscores the diverse approaches to blockchain utilization. As we continue to witness the evolution of these cryptocurrencies, their unique features and capabilities promise to pave the way for future advancements and applications that could transform multiple sectors.

Helpful Answers

What are the main purposes of Bitcoin and Ethereum?

Bitcoin serves primarily as a digital currency, while Ethereum enables a platform for building decentralized applications through smart contracts.

Which cryptocurrency is more secure?

Both Bitcoin and Ethereum have strong security measures, but Bitcoin's longer history and simpler structure may offer a slight edge in terms of network stability.

Can Bitcoin and Ethereum work together?

Yes, they can complement each other, with Bitcoin often used as a store of value and Ethereum facilitating decentralized applications and contracts.

How do transaction speeds compare between the two?

Ethereum generally offers faster transaction speeds compared to Bitcoin due to its block generation time, which is shorter than Bitcoin's.

Are there risks associated with investing in Bitcoin and Ethereum?

Yes, both cryptocurrencies are subject to market volatility, regulatory changes, and technological risks, making thorough research essential before investing.